The American beauty group controlled by Germany’s billionaire Reimann family has agreed to pay $600 million for a majority stake in the cosmetics brand founded by Kylie Jenner, the youngest member of the Kardashian-Jenner clan.

Coty Inc. just turned into Koty Inc. The American beauty group controlled by Germany’s billionaire Reimann family has agreed to pay $600 million for a majority stake in the cosmetics brand founded by Kylie Jenner, the youngest member of the Kardashian-Jenner clan. The deal, in which Coty will acquire a 51% stake, values Jenner’s Kylie Cosmetics business at about $1.2 billion, not bad for the line of lip kits the reality TV star created when still a teenager.

You can see why Coty is paying up for a piece of the “Konsumer” action. Jenner, with 270 million social media followers is at the vanguard of the celebrity-influencer beauty industry, where company founders engage their fans via Instagram and YouTube and turn them into customers.

Jenner — alongside other new media stars such as pop singer Rihanna, who’s partnered with LVMH Moet Hennessy Louis Vuitton SE, and the makeup artist Huda Kattan — is reshaping the beauty industry. Traditional cosmetics houses need to find ways to keep up. The mass beauty market, in which Coty has brands such as CoverGirl and MaxFactor, has been hit hard by the celebrity competition.

Coty’s deal values Kylie Cosmetics at 6.7 times the last 12 months’ revenue. That compares with the 3.6 times multiple paid by Sweden’s EQT Partners for Nestle Skin Health, a brand catering for a slightly older demographic. It seems contouring for millennials is twice as valuable as hiding crow’s feet.

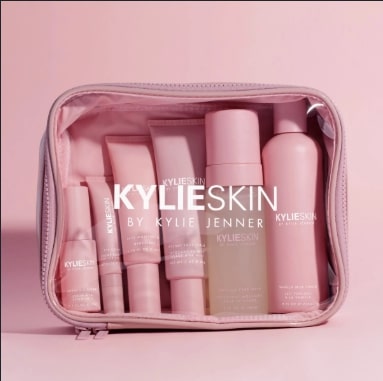

Jenner’s company sells only make-up and skincare products currently; Coty will license it fragrances and nail merchandise too. If the new parent can broaden Kylie’s appeal into everything from false eyelashes to gel nail varnish, and pump them through its global distribution network, then it has a chance of bolstering revenue and squeezing value from the deal price. The business is already growing quickly and has an Ebitda margin of more than 25%.

The danger of buying a “name” brand is that fashion is fickle. Coty’s purchase assumes that Kylie will keep inspiring young women to highlight their cheek bones and plump their lips. Yet what if she falls from favour with her young followers, who move onto the next Instagram or TikTok sensation. Already we may be past peak Kardashian, with the family’s TV show now into its 17th series.

Coty is eager to stress that this is a partnership, and that Jenner will remain heavily involved. But operating inside a behemoth is very different to being an entrepreneurial startup.

Let’s not forget the fate of the celebrity fragrance boom that emerged in the 2000s. These products are waning in popularity as millennials demand more personalized and artisanal scents. Coty itself has been moving away from some traditional collaborations, for example stopping producing perfumes for Jennifer Lopez, Lady Gaga and Celine Dion — although it still has Katy Perry in its stable.

Yet perfume tie-ups were for the analogue age; capturing a Kardashian is for the digital era. Investors will hope that doesn’t also mean an acceleration of the process of falling out of fashion.

For more update Click Here

For Information Source Click here